Contents:

Also try to remember how each item was bookkeeping servicesed in journal entry form when the transactions affecting these accounts happened. The balance in salaries payable that will be reported as a liability on Mamush Baker’s balance sheet is Br. 1500 will be reported together with the salary expenses of the year on the income statement. However, each time the company receives the service, the asset will be converted to an expense.

The only instances you’ll make journal entries in them are for end-of-year adjustments or under unusual circumstances. The following questions pertain to theadjusting entrythat should be entered in the company’s records. The company prepares financial statements at the end of each calendar month. The ending balance in the asset account Prepaid Insurance should be the cost of the insurance premiums that have been paid and which have not yet expired . Accruedrevenues are recorded because the bank has earned both the interest revenue and a related receivable and neither has yet been recorded by the bank.

The accounting cycle is performed during the accounting period, to analyze, record, classify, summarize, and report financial information. Notice that the balance of interest expense above is $800, which is the same amount of interest expense we debited if we didn’t make a reversing entry. Accounting software makes the journal entries “behind the scenes” whenever you enter an invoice, bill, and payment.

- Each adjusting entry will be prepared slightly differently.

- Therefore, the people who use the statements must be confident in its accuracy.

- The resulting debit balance of $250 in Temp Service Expense will be reported as a January expense.

- Upon signing the one-year lease agreement for the warehouse, the company also purchases insurance for the warehouse.

- Except for the merchandise – related accounts, the work sheet for a merchandising Co. is the same as for a service company.

- This is because, according to the accrual basis of accounting, the recognition of expense is not related to the payment of cash.

Global brands and the fastest growing companies run Oracle and choose BlackLine to accelerate digital transformation. BlackLine delivers comprehensive solutions that unify accounting and finance operations across your Oracle landscape. Retailers are recalibrating their strategies and investing in innovative business models to drive transformation quickly, profitably, and at scale. Save time, reduce risk, and create capacity to support your organization’s strategic objectives.

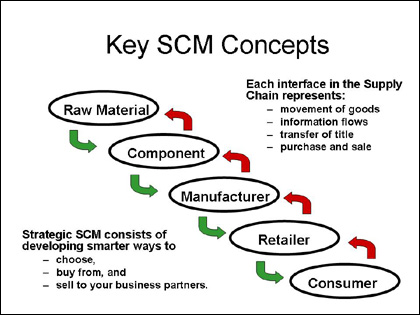

Alert: highest cash back card we’ve seen now has 0% intro APR until 2024

When the terms are FOB shipping point the buyer pays freight costs. The buyer takes the responsibility of safely moving these goods to his /her own place. The merchandise, therefore, becomes his/her property as soon as they are loaded on a truck or a train. Sometimes, the seller prepays the freight as a convenience to the buyer and later collects it on the due date of the invoice even though the terms are FOB shipping Point. FOB shipping Point –means “ free on board at shipping point”. It is, therefore, the buyer, which pays to the transportation company when the goods reach the buyer Briefly, when the terms are FOB Shipping Point the buyer pays transportation costs.

In contrast, for unearned revenues that will be earned in more than one period the labiality method of recording is preferable. The adjusting entry used in this case, debits an expense account and credit an asset for the amount that has expired i.e. the portion for which service has been received. The Income Summary account is a clearing account only used at the end of an accounting period to summarize revenues and expenses for the period. After transferring all revenue and expense account balances to Income Summary, the balance in the Income Summary account represents the net income or net loss for the period. Closing or transferring the balance in the Income Summary account to the Retained Earnings account results in a zero balance in the Income Summary. The Dividends account is also closed at the end of the accounting period.

- It’s also vital to tax return preparation and other government compliance regulations.

- Journal entries may also represent depreciation, which is the loss in value over time of a particular asset, like computer equipment.

- Nearly all adjusting entries involve a minimum of one balance sheet account and a minimum of one income statement account.

- Reversing entries are usually made to simplify bookkeeping in the new year.

If you use double-entry accounting, you also record the amount of money customers owe you. To protect your business, you can create an allowance for doubtful accounts. Initial Screen of Document DisplayDocument Entry View Post ReversalWe can see that the document is reversed as rent is credited and cash is debited.

Fundamentals of Financial Management, Concise Edition

Prepaid expenses are initially recorded as assets, but their value is expensed over time onto the income statement. Unlike conventional expenses, the business will receive something of value from the prepaid expense over the course of several accounting periods. An accrued expense, also known as an accrued liability, is an accounting term that refers to an expense that is recognized on the books before it has been paid. The expense is recorded in the accounting period in which it is incurred.

As you can recall, for both types of deferrals there are two methods of recording. That is, in the case of prepaid expenses the asset and expense methods and in the case of unearned revenues the liability and revenue methods of recording. Both alternative methods of recording deferrals result in the same effects on the financial statements. Then, the next logical question to ask is which method of recording to use. A reversing entry, as the name implies, is the exact reverse of the adjusting entry made at the end of the previous period.

The Types of Adjusting Entries

Record the same transaction for IKA Company if the merchandise were bought for cash. IKA Company bought goods worth Birr 43,000 from Saba Co., which is based in Addis Ababa, on account on January 4, 2001, terms 20/10, n/30. Assume the customer in the above example returned the goods on February 15 instead of February 5, after paying with in the discount period on February 13.

It is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Assets appear on the left side of the accounting equation and asset accounts will normally have debit balances. Accruals are revenues earned or expenses incurred which impact a company’s net income, although cash has not yet exchanged hands. On the other hand, an accrued expense is an event that has already occurred in which cash has not been a factor.

Since the 8 months service is not rendered it should NOT be reported as revenue. As a result, using an adjusting entry, which debits the revenue account and credits the liability account, we transfer the unearned portion to the liability account. Some balance sheet items have corresponding contra accounts, with negative balances, that offset them. Examples are accumulated depreciation against equipment, and allowance for bad debts against long-term notes receivable. Journal entries are used to record transactions in accounting and are made in the company’s general journal.

Compensating error

This can often be the case for professional firms that work on a retainer, such as a law firm or CPA firm. An accrued expense is an expense that has been incurred before it has been paid. For example, Tim owns a small supermarket, and pays his employers bi-weekly. In March, Tim’s pay dates for his employees were March 13 and March 27. At December 31, accrued salaries payable totaled $3,500. Accounts shown in the income statement columns of a worksheet.

A revenue accrual does not need to be made if an accounts receivable entry has already been recorded. If cash is received on or after July 1 for revenue that was not recorded in the current fiscal year, please process a revenue accrual. An expense accrual should be made for goods or services provided where the expenditure has not been recorded.

Physician Burnout Is A Public Health Crisis: A Message To Our … – healthaffairs.org

Physician Burnout Is A Public Health Crisis: A Message To Our ….

Posted: Tue, 28 Mar 2017 07:00:00 GMT [source]

If you have a supermarket business, would you use the perpetual or periodic system? Capital would have been overstated because of the overstatement of net income. For the year 1998, the end of the fiscal year, Dec. 31, falls on Wednesday. What adjustment is needed on December 31 in relation to salary expense. Capital would be understated, because the understated net income would be closed finally to the capital account.

The best way to https://1investing.in/ errors in accounting is to add a correcting entry. A correcting entry is a journal entry used to correct a previous mistake. By automating journal entries, organizations have cut time and effort around journal entry processing by as much as 90%. In the case of payroll, a journal will record the transaction as a debit in the wage expenses account and as a credit in the cash account. According to the double entry system, debits are recorded in the left-hand column of the ledger, and credits are recorded in the right-hand column. In the double entry system, debits and credits always add up.

Does not change is going down could move in either direction rises significantly None of the above. After the January 1 reversing entry, the account Accrued Expenses Payable will have a zero balance, and the account Temp Service Expense will have an unusual credit balance of $18,000. Reversing entries work to clear out any accruals that you do not want reflected in the new accounting period. A reversing entry is often used in payroll, but may also be used to fix errors like miscalculating revenue. To reverse the account, debit your Accounts Receivable account and credit your Allowance for Doubtful Accounts for the amount paid.

Unlike adjusting entries, reversing entries are optional, i.e., without the use of reversing entries we can prepare correct financial statements. Reversing entries are journal entries made at the beginning of each accounting period. The sole purpose of a reversing entry is to cancel out a specific adjusting entry made at the end of the prior period, but they are optional and not every company uses them. Most often, the entries reverse accrued revenues or expenses for the previous period. Some examples of reversing entries are salary or wages payable and interest payable. A prepaid expense is a type of asset on the balance sheet that results from a business making advanced payments for goods or services to be received in the future.

Indicate, in the sequence in which they are made, the three required steps in the accounting cycle that involve journalizing. The use of a worksheet is an optional step in the accounting cycle. Reversing entries are made after completing the closing of the prior reporting period. Adjusting entries are posted at the end of the fiscal…

401 and Retirement Help employees save for retirement and reduce taxable income. Employee Benefits Offer health, dental, vision and more to recruit & retain employees. Business Insurance Comprehensive coverage for your business, property, and employees. And make sure there’s someone knowledgeable in accounting entries who can answer questions when they arise.